View: Time For Government, Private Sector To Pick Up Pace To Strengthen Defence

by Gaurav Mehndiratta & Rajat Duggal

A steady flow of orders and opportunities of export are the most essential in continuing the economies of scale required for the survival of such investments. On the other hand, after years of dialogue with the MoD now that the policy environment is shaping up, it is for the OEMs to seize the opportunity and showcase their commitment towards the Indian market.

Defence has been a priority sector for the Indian Government since 2014, both for realising its objective of ‘Make in India’ and ‘Atmanirbhar Bharat’. Despite the fact that the high gestation and capital-intensive sector has tremendous opportunities for employment and export generation, the sector has always been marred by red-tapeism. Even though India always aspired to play the role of a regional superpower, the country’s prowess in defence manufacturing has not done justice to its potential.

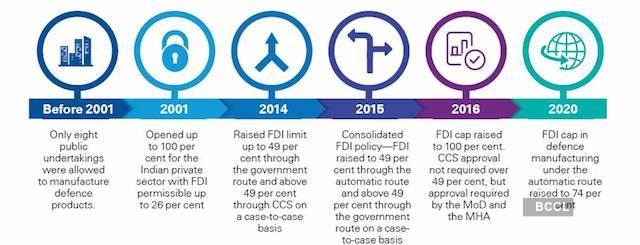

One of the major factors influencing this is the complex policy framework governing the sensitive sector. Until 2001, even the domestic private industry was not permitted to invest or undertake manufacturing in the sector. Only in the last 20 years, the defence sector has been liberalised and given the due importance, yet it still has had to deal with policy complexity.

In year 2020, a slew of measures which are significant for investment, manufacturing, export and growth of defence sector, were introduced by the Indian Ministry of Defence (MoD). Release of Defence Acquisition Procedure 2020, hike in Foreign Direct Investment (FDI) threshold, import embargo, Public procurement order, release of draft Defence Production and Export Promotion Policy (DPEPP) etc, are some of the measures towards creation of a conducive policy environment.

Increase In Foreign Direct Investment (FDI) Cap To 74 Percent- A Major Positive

In May 2001, the Government opened the defence arena for 100% participation by the private sector and permitted FDI up to 26% for licensable products (prior to this the sector was reserved for public enterprises).

Since then, there have been changes to FDI conditions and threshold, but the same did not reap the desired results as the foreign Original Equipment Manufacturers (OEMs) were seeking control beyond 49 percent.

Recently, the FDI threshold has been raised from 49 percent to 74 percent under the automatic route. Further, 100% FDI is permitted for products not requiring Industrial license (IL). Foreign OEMs shall now be able to exercise control in Indian companies. It is worth noting that a vast majority of products which do not require an IL can anyway be manufactured in India under the 100% FDI route.

With the this wish list granted, it is expected from the OEM community to make the best use of the liberalised regime which seeks to expand the Indian footprint. With Government’s increased focus on indigenous procurement, companies making investment in the sector are likely to benefit for future tendering which is likely to favour Indian set-ups with higher indigenous content.

Import Ban- Stacking Procurement For Indian Companies

In a major push to local defence manufacturing, the Government introduced an import embargo on 101 defence items and another comprehensive list is underway. With a commitment to procure the products locally, this move is geared towards augmenting the cause of self-reliance and indigenisation of defence platforms.

However, one cannot overlook the shortage for specialised raw material, technology etc in the country for defence manufacturing. The Government may consider bringing in a policy for incentivising the transfer of technology and specialised raw material by foreign OEMs which shall go long way in strengthening the relatively nascent sector.

Draft Defence Production And Export Promotion Policy (DPEPP)

The MoD introduced the draft DPEPP with focus on dynamic defence, aerospace and shipbuilding industry, for reducing dependence on imports, for promoting export of defence products and creating an environment that fosters innovation and R&D. Under the draft policy, the MoD has laid out an ambitious target to scale up the currently estimated turnover of about INR 80,000 crore (USD 10,700 million) in 2019-20 and achieve a turnover of INR 1,75,000 crore (USD 25,000 million) including export of INR 35,000 crore (USD 5,000 million) in Aerospace and Defence goods and services by 2025. MoD has bifurcated the capital procurement budget between domestic and foreign capital procurement routes. Thus, going forward, a separate budget shall be carved out for domestic purchase.

The draft DPEPP also addresses the synergies between civil aviation and defence sector. One expects that both the Ministries, would re-align the policy framework which support co-development and strengthen the aerospace ecosystem in entirety.

Revision of Defence Acquisition Procedure

The MoD has released the Defence Acquisition Procedure 2020 which lays down significant changes with a focus on ‘Make in India’ for the sector. Some of the key changes are:

Increased indigenisation threshold, thus, compelling higher levels of local manufacturing;New procurement category (Buy (Global manufacture in India)) notified to permit subsidiaries of foreign OEMs to implement contract in India by meeting the indigenisation requirements;Concept of leasing of defence products has been introduced;Offset guidelines made more outcome based with higher incentives for technology transfer and investment in defence industrial corridors.

Tax And Other Incentives

With the aim of setting up flourishing maintenance, repair and overhaul (MRO) sector in the country, the goods and services tax rate for the sector was reduced from 18 percent to 5 percent with full input tax credit with effect from April 1, 2020 to liberalise the tax regime. Furthermore, slashing of headline corporate tax rates to 22 percent and 15 percent, coupled with the enhanced FDI cap, will, hopefully, bring two-fold benefits for the defence sector.

The Way Forward

With these changes, the Government has made the first and most essential move in the direction of establishing a policy environment which is favourable for investment, manufacture and export. One expects that with a little more push the sector will witness the same interest as IT and Automotive. In a single customer driven sector, it is essential that the Government ensures that the private industry is equally respected and incentivised as the public sector. A steady flow of orders and opportunities of export are the most essential in continuing the economies of scale required for the survival of such investments. On the other hand, after years of dialogue with the MoD now that the policy environment is shaping up, it is for the OEMs to seize the opportunity and showcase their commitment towards the Indian market.

No comments:

Post a Comment