Here Is What's Causing The Stock Rally In The Defence Sector

India's focus on local defence manufacturing has started to pay off for several domestic firms.

Shares of defence equipment manufacturers from Bharat Dynamics Ltd. to Hindustan Aeronautics Ltd. and Zen Technologies Ltd. have surged more than the benchmark so far this year. On average, they have tripled investor wealth over the last five years.

The rise mirrors the growing order books of defence companies over the years. The growth is mainly backed by orders awarded to domestic companies—to make or contribute to the production of various defence equipment.

In fiscal 2023, India's defence production crossed the Rs 1 lakh crore mark for the first time, as the Ministry of Defence continued to emphasise on local production through the introduction of Positive Indigenization Lists that have embargoes on imports of certain items.

As of FY23, the value of defence production stood at Rs 1.06 lakh crore, which was a rise of above 12% over the FY22 figure of Rs 95,000 crore.

The defence budget surged 13% in FY24 to Rs 5.9 crore, which has also helped boost the order books of domestic players.

Here is the budget outlay for FY24:

Based on the average returns of 10 companies in the sector, defence stocks have shot up over 275% in five years, over 99% in a year, and over 50% year-to-date, according to Bloomberg data.

The approximate returns of these companies are as follows:

While the sector has visibility of growth, the question remains whether there is any more upside potential. And if so, then what is causing this upside?

Here's A Look At The Factors At Play:

Exponential Order Book Growth

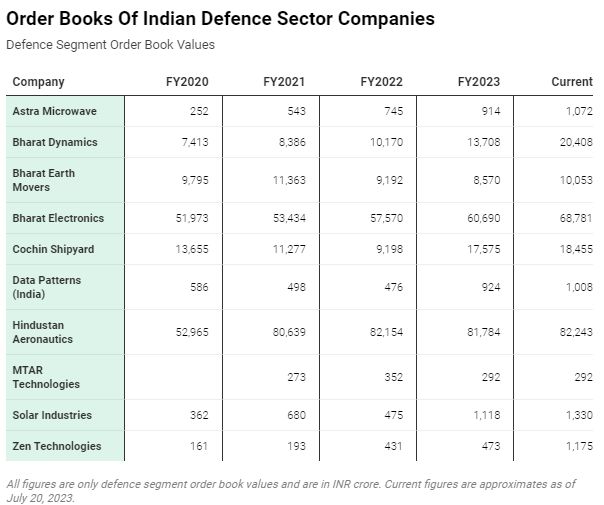

The order books of defence companies have seen healthy growth over the years owing to the indigenisation mandate, increased defence production, reduced imports and increased exports.

Astra Microwave Products Ltd., Solar Industries India Ltd. and Zen Technologies have the highest four-year order book compound annual growth rate of 38.06%, 32.57% and 30.95%, respectively.

Bharat Dynamics, Data Patterns (India) Ltd. and Hindustan Aeronautics have a four-year order book CAGR towards the lower end at 16.61%, 12.09% and 11.47%, respectively.

It is followed by Cochin Shipyard Ltd. with a CAGR of 6.51% and Bharat Electronics Ltd. with CAGR of 3.95%. MTAR Technologies Ltd.'s three-year order book CAGR is at 2.30%.

The only company that has negative growth is Bharat Earth Movers Ltd., with a-3.28% CAGR.

Attractive Book-To-Bill Ratio

Of the 10 companies, Cochin Shipyard, Bharat Dynamics, Bharat Electronics and Hindustan Aeronautics have the most appealing book-to-bill ratio of 7.43, 5.51, and 3.42 respectively, as of FY23.

Indigenisation Mandate

The government's effort to promote ‘Atmanirbharta’ (self-reliance) in defence and to minimise imports by public sector undertakings resulted in four Positive Indigenization Lists, comprising 411 major weapons platforms and systems, with an embargo on their import from defined timelines.

More than 26,000 defence items have been offered to the industry for indigenisation. Of this, 7,031 items have already been indigenised as of March 20, according to information given by Minister of State for Defence Ajay Bhatt.

Declining Imports And Rising Exports

Defence imports have reduced from 46% to 36.7% since FY19, according to data available till December 2022.

India hit a milestone in defence exports in FY23. It reached an all-time high of approximately Rs 16,000 crore, which is almost Rs 3,000 crore higher than FY22 and a rise of over 10 times since FY17.

As of April 1, India has exported defence products to over 85 countries, with 100 firms exporting the products.

The government aims to achieve a turnover of Rs 1.75 lakh crore —including exports of Rs 35,000 crore in aerospace and defence goods and services by FY25.

No comments:

Post a Comment